We are the go to resource for figuring out how to get your finances into check. Learn financial strategies, find resources, and more.

(Washington, D.C.) — If you have unsecured debt you have probably heard of what most experts are calling the “Debt Bailout”.

Much like the mortgage and student debt bailout several years ago, millions of Americans are having their debt settled, or in some cases completely eliminated through the Hardship Relief Program (HRP) available to those with $10,000 or more in unsecured debts. The great news is several types of debts are qualified for the program and those who take advantage can see drastic relief, typically as much as up to 65% of the total balances on:

According to the Washington Post, More Americans are leaning on their credit cards in the face of rising prices. And as interest rates continue to climb, that debt is getting a lot more expensive.

The average credit card user was carrying a balance of $8,474 last fall, according to TransUnion, up 13% from 2021.

That marks a uptick from the first year of the pandemic, when many Americans were able to pay down unsecured debt, thanks to generous government relief payments and limited spending on travel and entertainment.

As balances balloon again, they can cast a long shadow over family finances. Here’s what to know about rising credit card debt – and what you can do about it.

Americans are rushing to enroll in the Hardship Relief Program to get immediate assistance with high debt loads, harrassing creditors and get the help they deserve and are entitled too. As such, due to high demand, the Harship Relief Program has established a central helpline at (877) 300-8506 where consumers can automatically connect with an HRP counselor and freely explore their options for relief.

Americans with lower debt and lower payments have more money to inject into the economy, simple as that. Consumer spending drops amongst those in heavy debt which accounts for nearly 80% of the households in the US.

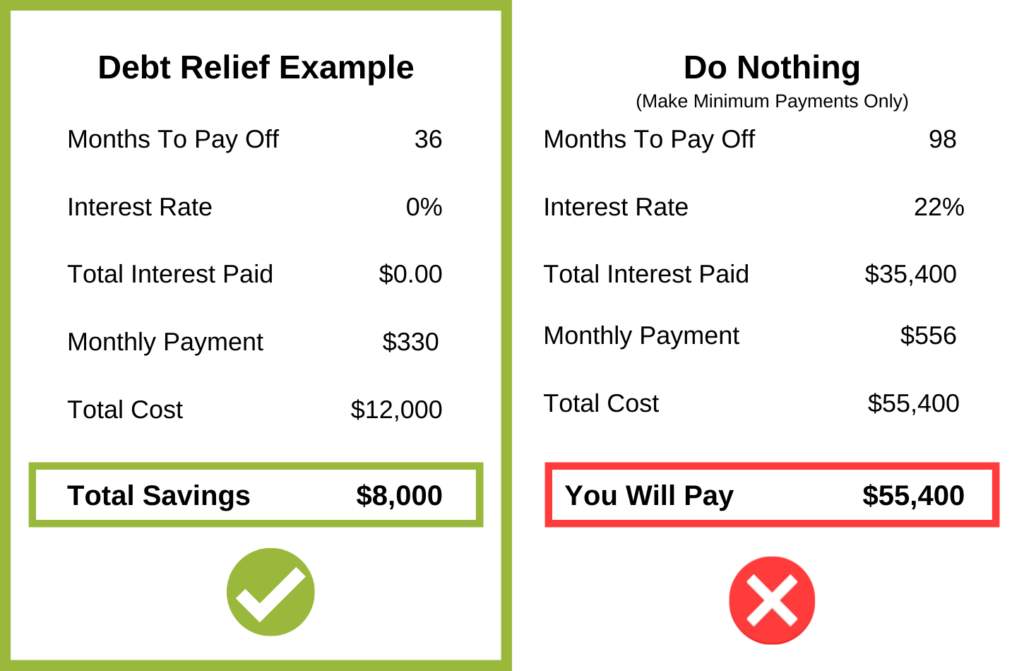

According to the HRP, there are several options that HRP counselors review with candidates and that there is no one size fits all, but there is a solution, for everyone. Those taking advantage are seeing benefits ranging from lower monthly payments, significant reducation in balances , reduced interest, and much more.

Our readers suffering from the burden of carrrying high debt should not continue to suffer. Give the HRP helpline a call immediately to see what benefits you qualify for now. Those with debts of $10,000 or more have the potential to save thousands with their assistance.

You can call the helpline number 1 (877) 300-8506 to see how much help you qualify for.

“I used to lose my sleep at night thinking about my $78,000 in credit card debt and every month the amount just kept increasing… I now feel like there are so many possibilities and options for me. I was finally able to take my wife and kids on vacation without feeling like I’m drowning in more and more debt. Everyone should take advantage of this debt relief program while its still available!”

If you find yourself burdened by high interest, unmanageable debt, you are not alone. You are just one of the over 80% of Americans who owed financial institutions more than $14.3 trillion at the end of 2021.

The time to act is now. If you or a loved one is struggling with credit card debt, it’s not your fault and you’re not alone.

Thankfully, through the Hardship Relief Program, there are several new programs aimed at reducing payments and interest, discharging or even cancelling unsecured debt owed by millions of struggling Americans. Though not everyone qualifies for these programs, there are several options available for any type of situation. Over 40 Million Americans are currently struggling with credit card debt, living paycheck to paycheck.

Please help others and share this article & post your before/after debt amounts thanks to this company in the comments section for our editors to highlight.

Questions? Call 877-300-8506