The Emotional Toll of Credit Card Debt

As recent studies reveal, Generation X holds the highest amount of credit card debt among all generations, with a staggering total of $189.2 billion. With financial responsibilities increasing and the economy in constant flux, many Gen X’ers feel the overwhelming burden of managing their debt. The mounting stress caused by this situation not only affects their financial stability but also takes a toll on their emotional well-being.

For many, the emotional pain of being in debt can be all-consuming. Struggling to make ends meet, receiving constant calls from creditors, and feeling trapped in an endless cycle of debt can lead to feelings of hopelessness and despair. However, it’s essential to remember that there is help available for those who seek it.

Freedom Debt Network: Your Path to Credit Card Debt Freedom

Freedom Debt Network, a leading debt relief service, has helped countless individuals find a way out of the seemingly inescapable grip of credit card debt. By offering customized solutions tailored to each client’s unique financial situation, Freedom Debt Network can help you regain control of your finances and achieve the financial freedom you deserve.

Take Action: Regain Your Financial Stability

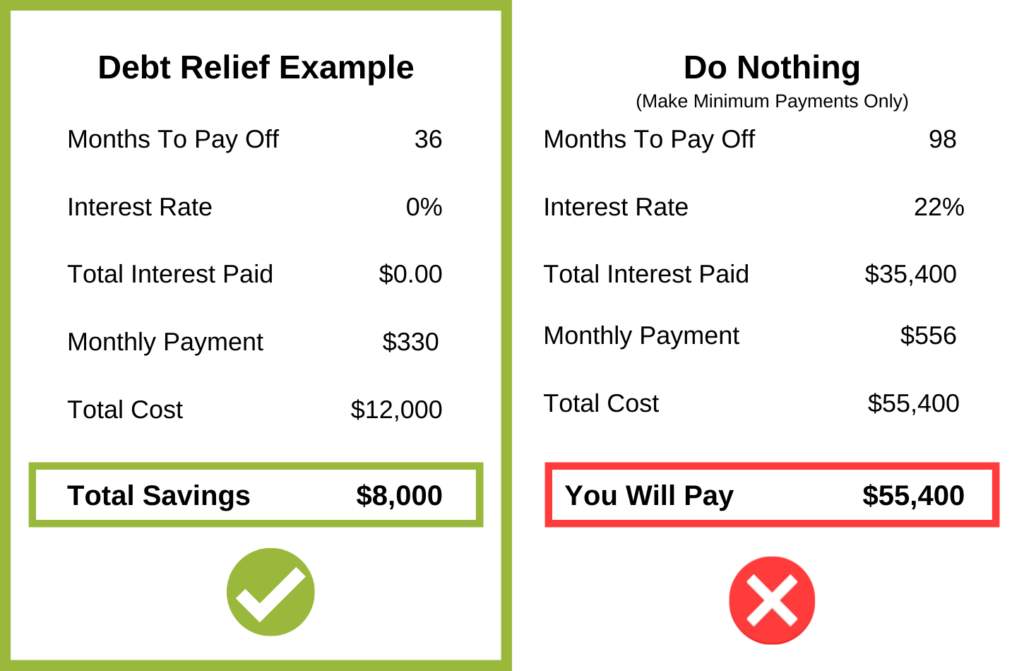

When you reach out to Freedom Debt Network for a consultation, their team of experienced professionals will work with you to create a personalized plan to tackle your credit card debt. Whether it’s through debt consolidation, debt settlement, or other inhouse programs, they can help you navigate the path towards financial stability.

As a Gen X’er, you’ve lived through some of the most significant economic and cultural changes in recent history. You’ve had to adapt and overcome countless challenges, and your resilience has been tested time and time again. Now, with the help of Freedom Debt Network, you can confront the challenge of credit card debt head-on and regain the financial stability you’ve been longing for.

Don't Wait: Secure Your Debt-Free Future Today

Don’t let the emotional pain of debt control your life any longer. It’s time to take the first step towards financial freedom by contacting Freedom Debt Network. Click here to call or visit their website to schedule a debt relief consultation. Remember, you don’t have to face this burden alone – Freedom Debt Network is here to help you every step of the way.

Questions? Call 877-300-8506

That's Life Advice

That's Life Advice. Everyday Living Simplified. Designed to simply your everyday life.

Latest

[Exclusive] Experts Warn Of A Global Recession, New Program Is Helping Americans Get Out of $10k-$125k in Credit Card Debt

10 Smart Strategies Everyday Americans Are Using To Save Money on Everyday Expenses

Americans With $8k – 80k In Credit Card Debt Could Qualify For $8,673 Or More Back in Their Pockets, Through Hardship Program Savings!

Popular

[Exclusive] Experts Warn Of A Global Recession, New Program Is Helping Americans Get Out of $10k-$125k in Credit Card Debt

10 Smart Strategies Everyday Americans Are Using To Save Money on Everyday Expenses

Americans With $8k – 80k In Credit Card Debt Could Qualify For $8,673 Or More Back in Their Pockets, Through Hardship Program Savings!

© 2022 tagDiv. All Rights Reserved. Made with Newspaper Theme.