BREAKING: Credit Card Debt Hits $930B - Hardship Program Offers Relief To Millions

(Washington, D.C.) — The “Debt Bailout” has become a widely discussed topic among individuals with unsecured debt.

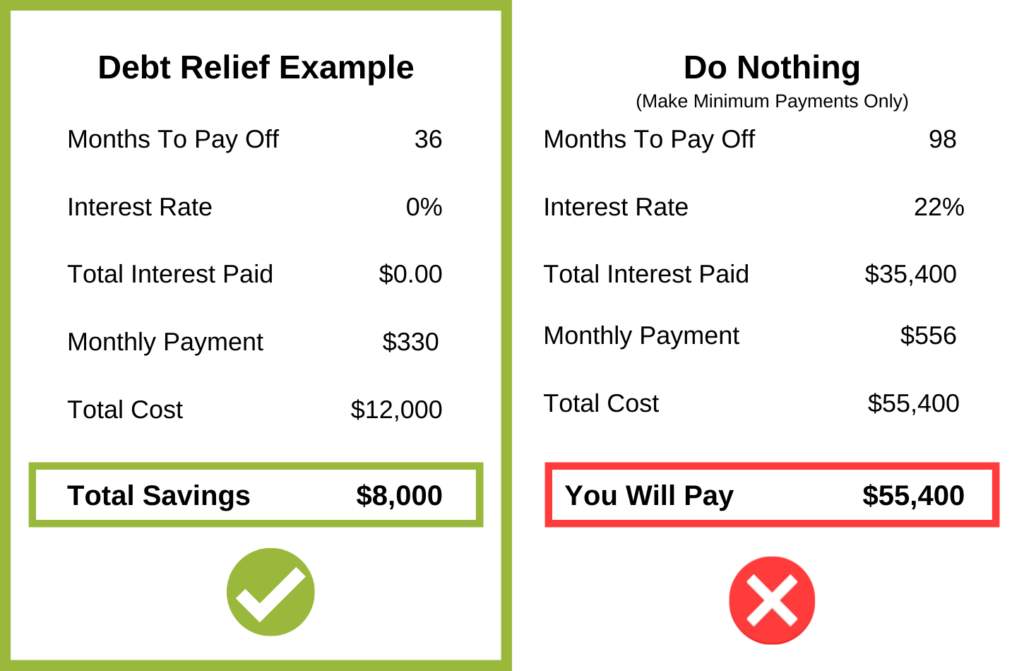

Similar to the mortgage and student debt bailout from a few years back, the Hardship Relief Program (HRP) has now allowed millions of Americans with at least $10,000 in unsecured debts to have their debts resolved or even completely eliminated. The positive aspect is that various kinds of debts are eligible for this program, and those who participate can experience significant relief, generally up to 65-70% of their total balances on:

- Credit Cards

- Medical Bills

- Collections Accounts

- Personal and Payday Loans

- Debts Not Tied to Collateral

- Tax Debts

The Washington Post reports that an increasing number of Americans are relying on credit cards amidst escalating prices. Moreover, as interest rates keep rising, these debts become even more costly.

In the fall, the average credit card user had a balance of $8,474, according to TransUnion, which is a 13% increase from 2021.

This growth contrasts with the initial year of the pandemic when many Americans managed to reduce unsecured debt due to substantial government relief payments and restricted spending on travel and entertainment.

As debt balances swell once more, they can have lasting effects on household finances. It’s crucial to be aware of increasing credit card debt and the available solutions.

Many Americans are hurrying to sign up for the Hardship Relief Program to receive immediate support for high debt burdens and protection from aggressive creditors. Due to high demand, the Hardship Relief Program has set up a central helpline at (877) 300-8506, where consumers can directly connect with an HRP counselor and openly discuss their options for debt relief.ddxxdfxdfxdfxdxddx

What is the Process?

When Americans have less debt and smaller payments, they have more funds to contribute to the economy – it’s as straightforward as that. A decline in consumer spending is observed among those burdened with significant debt, which represents nearly 80% of US households.

The HRP states that its counselors review multiple options with applicants, as there is no one-size-fits-all solution. However, they assure that there is a suitable option for everyone. Participants can experience benefits such as lower monthly payments, considerable balance reductions, decreased interest rates, and much more.

Our readers who are struggling with the weight of substantial debt should not continue to endure this hardship. Reach out to the HRP helpline right away to find out which benefits you are eligible for. Those with debts of $10,000 or more have the opportunity to save thousands through the HRP’s assistance.

Click and Call the helpline number (877) 300-8506 to determine the extent of help you qualify for as soon as possible.

A Widespread Challenge

"I was constantly kept awake at night, worrying about my staggering $43,000 in credit card debt, which seemed to grow with each passing month. However, since discovering this program, my outlook has changed dramatically. I now see a world full of opportunities and choices before me. I could finally treat my wife and children to a much-deserved vacation without feeling suffocated by an ever-increasing mountain of debt. I wholeheartedly believe that everyone should seize the chance to benefit from this life-changing debt relief program while it's still accessible!"

How Can I Determine My Eligibility and Obtain Assistance If I'm Struggling with Significant Debt?

If you’re grappling with high-interest, unmanageable debt, rest assured that you’re not the only one. In fact, more than 80% of Americans found themselves in a similar situation, owing financial institutions over $14.3 trillion by the end of 2021.

NOW is the time to take action. If you or someone close to you is struggling with credit card debt, understand that it’s not your fault, and you’re not alone in this struggle.

Fortunately, the Hardship Relief Program offers various new initiatives designed to decrease payments and interest rates, as well as discharge or even cancel unsecured debt for millions of Americans facing financial difficulties. While not everyone is eligible for these programs, there are multiple options tailored for different circumstances. Over 40 million Americans are currently struggling with credit card debt and living paycheck to paycheck.

We encourage you to share this article and post your before-and-after debt amounts, thanks to this company, in the comments section. Our editors will highlight these stories to help others.

What are the Next Steps?

- Call the Hardship Relief Program at (877) 300-8506 ask to check your eligibility, Monday thourgh Friday 8am – 5pm PST.

- Get your no-cost evaluation and review in depth all your options for relief.

- Gain peace of mind as you take back control of your financial health.

Questions? Call 877-300-8506

That's Life Advice

That's Life Advice. Everyday Living Simplified. Designed to simply your everyday life.

Latest

[Exclusive] Experts Warn Of A Global Recession, New Program Is Helping Americans Get Out of $10k-$125k in Credit Card Debt

10 Smart Strategies Everyday Americans Are Using To Save Money on Everyday Expenses

Americans With $8k – 80k In Credit Card Debt Could Qualify For $8,673 Or More Back in Their Pockets, Through Hardship Program Savings!

Popular

[Exclusive] Experts Warn Of A Global Recession, New Program Is Helping Americans Get Out of $10k-$125k in Credit Card Debt

10 Smart Strategies Everyday Americans Are Using To Save Money on Everyday Expenses

Americans With $8k – 80k In Credit Card Debt Could Qualify For $8,673 Or More Back in Their Pockets, Through Hardship Program Savings!

© 2022 tagDiv. All Rights Reserved. Made with Newspaper Theme.