How Americans Are Navigating The Credit Card Debt Landscape in the US and Saving Thousands

As credit card debt continues to surge in the United States, with the average household owing over $8,000, it’s essential to shed light on the causes, effects, and potential solutions to this growing financial dilemma. This post will explore the issue of credit card debt in America and discuss ways to address this challenge.

A major contributing factor to the rise in credit card debt is the accessibility and aggressive marketing of credit. Card issuers entice consumers with appealing offers, including low introductory interest rates, cash back incentives, and travel rewards. Unfortunately, many individuals, especially those lacking financial knowledge, find themselves falling into debt as they struggle to resist these tempting offers.

The exorbitant interest rates tied to credit card debt often lead to a relentless cycle. As outstanding balances grow, individuals find it increasingly difficult to pay off their debts, resulting in lower credit scores. This, in turn, can restrict access to affordable loans, further worsening financial difficulties.

The repercussions of credit card debt aren’t limited to individuals; the American economy also bears the burden. When consumers are weighed down by debt, they have less disposable income to spend on goods and services, potentially slowing economic growth and even contributing to recessions.

To tackle this multifaceted problem, a comprehensive approach is necessary. Prioritizing financial education in schools and communities can help ensure individuals are well-versed in credit card usage and debt management. Moreover, lawmakers should contemplate introducing regulations to curb predatory lending practices and promote transparency in credit card offers.

In summary, addressing credit card debt in the US requires both individual and systemic changes. By fostering financial literacy and promoting responsible lending practices, we can work towards a future where credit card debt no longer jeopardizes the financial stability of American families.

Strategies for Reducing Credit Card Debt with Freedom Debt Network

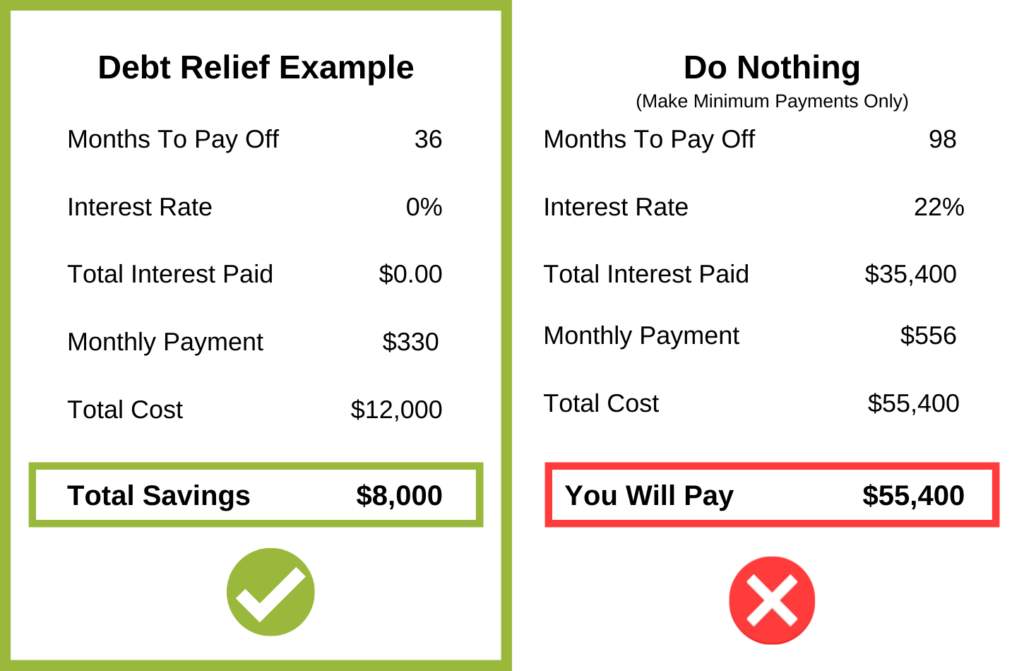

For those already struggling with credit card debt, several strategies can help reduce or even eliminate the burden. One such solution is to enlist the help of a preferred debt resolution service provider, like Freedom Debt Network. This company specializes in assisting those with $10,000 or more in credit card debt to reduce and even eliminate their debt you can take their 2-minute quiz here: Freedom Debt Network to find out if you’re eligible for assistance. The following methods, including working with Freedom Debt Network, are some of the most effective ways to manage and overcome credit card debt:

-

Create a budget: Establishing a budget can help individuals track their spending and identify areas where they can cut back. By monitoring expenses and setting limits, individuals can allocate more money towards paying off their credit card debt.

-

Prioritize high-interest debt: Focus on paying off the credit cards with the highest interest rates first. This approach, known as the “avalanche method,” minimizes the overall interest paid and can help individuals become debt-free faster.

-

Consider debt consolidation: Debt consolidation involves combining multiple credit card balances into a single loan, ideally with a lower interest rate. This can simplify debt management and potentially save money on interest payments.

-

Seek professional help from Freedom Debt Network: Freedom Debt Network is a reputable debt resolution service provider that can offer guidance and support to individuals struggling with credit card debt. With a proven track record of helping clients reduce and even eliminate their debt, Freedom Debt Network works with individuals to create a personalized plan tailored to their financial situation. Their team of experts can provide ongoing assistance throughout the debt resolution process, helping clients regain control of their finances.

-

Negotiate with creditors: In some cases, individuals can negotiate directly with their credit card companies to lower interest rates or create a payment plan that better suits their financial situation. This approach requires persistence and strong negotiation skills but can result in significant savings.

For those who are struggling and in urgent need of assistance, call the Freedom Debt Network helpline number 1 (877) 300-8506 to see how much help you qualify for.

My Experience and Relief Story

"When I first reached out to Freedom Debt Network, I was at the end of my rope. I had accumulated over $25,000 in high-interest credit card debt, and I could barely make the minimum payments each month. The sleepless nights, constant stress, and feelings of shame were overwhelming. I felt trapped, and it seemed like there was no way out of the vicious cycle. From my very first call with Freedom Debt Network, I felt a glimmer of hope. Their compassionate and understanding representative, Sarah, listened to my story without judgment and assured me that I wasn't alone. She told me about the many people they've helped who were once in my situation. Working with Freedom Debt Network, we developed a personalized plan to tackle my debt. Over the next few months, their expert negotiators managed to significantly lower my interest rates and monthly payments. With their guidance, I was able to make steady progress and finally see the light at the end of the tunnel. Throughout the entire process, the team at Freedom Debt Network provided unwavering support and encouragement. They were always there to answer my questions and celebrate my milestones, no matter how small. Today, I am proud to say that I am debt-free, thanks to Freedom Debt Network. The relief and sense of accomplishment I feel is indescribable. I can finally breathe again, knowing that I have regained control of my finances and my life. If you're struggling with high-interest credit card debt, I cannot recommend Freedom Debt Network enough. They genuinely care about their clients and will do everything in their power to help you regain your financial freedom. Don't suffer in silence - reach out to them today and start your journey towards a debt-free future."

Assessing Your Eligibility and Seeking Assistance for Overwhelming Debt

If you find yourself burdened by high-interest, unmanageable debt, you are not alone. You are just one of the over 80% of Americans who owed financial institutions more than $14.3 trillion at the end of 2021.

The time to act is now. If you or a loved one is struggling with credit card debt, it’s not your fault, and you’re not alone. Thankfully, Freedom Debt Network is here to help.

Through the Hardship Relief Program, Freedom Debt Network offers several new programs aimed at reducing payments and interest, discharging, or even canceling unsecured debt owed by millions of struggling Americans. While not everyone qualifies for these programs, there are several options available for any type of situation. Over 40 million Americans are currently struggling with credit card debt, living paycheck to paycheck.

Freedom Debt Network has a proven track record of helping people regain control of their finances and break free from the crushing weight of credit card debt. Their dedicated team of experts will work closely with you to develop a personalized plan tailored to your unique situation.

Please help others and share this article. We encourage you to post your before/after debt amounts thanks to Freedom Debt Network in the comments section, and our editors may highlight your story. Let’s spread the word about this life-changing company and help more people break free from the chains of debt.

What are the Next Steps?

- Call the Freedom Debt Network Hardship Relief Program at (877) 300-8506 and ask abut the Hardship Program, Monday thourgh Friday 8am – 5pm PST.

- Get your no-cost evaluation and review in depth all your options for relief.

- Gain peace of mind as you take back control of your financial health.

Questions? Call 877-300-8506

That's Life Advice

That's Life Advice. Everyday Living Simplified. Designed to simply your everyday life.

Latest

[Exclusive] Experts Warn Of A Global Recession, New Program Is Helping Americans Get Out of $10k-$125k in Credit Card Debt

10 Smart Strategies Everyday Americans Are Using To Save Money on Everyday Expenses

Americans With $8k – 80k In Credit Card Debt Could Qualify For $8,673 Or More Back in Their Pockets, Through Hardship Program Savings!

Popular

[Exclusive] Experts Warn Of A Global Recession, New Program Is Helping Americans Get Out of $10k-$125k in Credit Card Debt

10 Smart Strategies Everyday Americans Are Using To Save Money on Everyday Expenses

Americans With $8k – 80k In Credit Card Debt Could Qualify For $8,673 Or More Back in Their Pockets, Through Hardship Program Savings!

© 2022 tagDiv. All Rights Reserved. Made with Newspaper Theme.